How to Hack Back Into My Instagram Account

Finding out that your personal information was compromised and may have gotten into the wrong hands is never good news. And many Americans found this out the hard way due to a data breach involving Equifax, one of the three major credit bureaus.

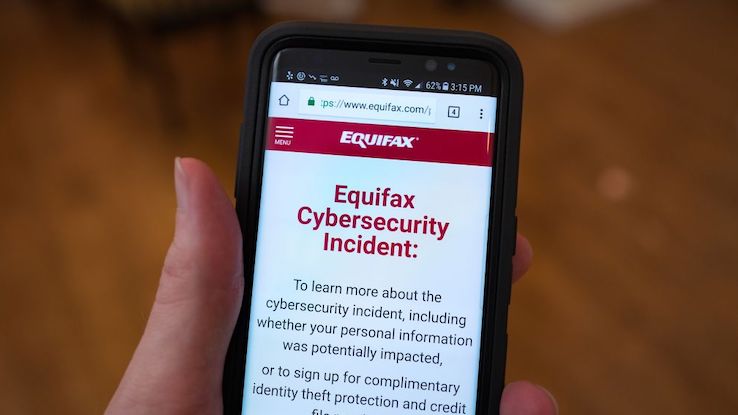

To find out whether you're one of the millions of Americans whose personal information may have been compromised during the massive Equifax data breach that occurred in 2017, you can visit a specific website and fill in basic information to check your status. The initial deadline to file a claim in the Equifax settlement was in January 2020, but you may still be eligible for additional assistance, including free identity restoration services, through 2026. Knowing the best ways to keep your personal information safe can also be helpful if something similar happens in the future.

Equifax is one of the three major credit bureaus, alongside Experian and TransUnion. It collects financial information about millions of Americans, including details about their debts, to help determine their creditworthiness and whether they're risky for financial institutions to lend to. It also sells services, such as fraud protection and credit monitoring, directly to consumers and helps people keep track of their credit status.

Aside from obtaining your credit report and score, you can use Equifax to protect yourself from identity theft, use various tools to prepare to make a large purchase (such as a home or new car) and obtain a free copy of your Equifax credit report, which shows credit-related information about you. You can also enact alerts and freeze reporting when you need to inform lenders that you've been (or could become) a victim of fraud.

Was My Information Part of the Breach?

In September 2017, Equifax announced a data breach that exposed the personal information of 147 million people had taken place. Among the compromised information were home addresses, phone numbers, birth dates, names, drivers license numbers and Social Security numbers. The attack also breached credit card numbers and expiration dates of nearly 209,000 customers. Following the attack, Equifax created a separate website, https://www.equifaxsecurity2017.com/, for individuals to use to find out whether their information had been compromised as part of this breach.

If you're not sure whether your information has been compromised, you can visit the official settlement website for the Equifax Data Breach Settlement at https://www.equifaxsecurity2017.com. To start, fill out your last name and the last six digits of your Social Security number. From there, you'll find out whether your personal information was exposed during the breach.

How Can I Keep My Personal Information Safe?

You're legally allowed to get a free copy of your credit report from every credit reporting bureau every 12 months. Once you obtain your report, comb through it to ensure that all of your information is updated and correct. Reviewing your reports on a regular basis allows you to potentially catch warning signs of identity theft. Look for unpaid accounts that you're certain you didn't open.

Another option is to put a freeze or lock on your credit report. You can do this with Equifax, TransUnion and Experian. Each of these three major credit bureaus also lets you place fraud alerts on your credit report. This notice lets lenders and others who pull your credit report know that you may have been a victim of identity theft and some information that appears on your credit report may be incorrect.

What Happens Now?

Following the data breach, a lawsuit was generated between affected individuals, Equifax Inc. and two of its subsidiaries. Under the settlement, Equifax agreed to pay $425 million to assist those affected by its data breach.

If you were impacted by the breach, you could be eligible for reimbursement up to $20,000 to help cover the money you spent to protect yourself against identity theft, including freezing or unfreezing credit reports, and the time you spent protecting your identity or recovering from identity theft.

The initial deadline for filing a claim in the Equifax settlement was January 22, 2020. However, you can still file a claim for expenses incurred between January 23, 2020, and January 22, 2024, regarding fraud related to the breach or identity theft. You can also file a claim for time spent recovering from fraud or identity theft during this time period. If you don't file a claim, you may still be able to get free identity restoration services along with six free credit reports through 2026, in addition to your one free Equifax report.

MORE FROM ASKMONEY.COM

How to Hack Back Into My Instagram Account

Source: https://www.askmoney.com/investing/was-my-equifax-account-hacked?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex